How leading LPs systematically distinguishes exceptional fund managers from the pack

In today's competitive private equity landscape, identifying truly exceptional managers requires more than just analyzing returns. The most sophisticated LPs have developed systematic approaches to cut through the noise and identify GPs who can deliver sustainable, repeatable success.

The challenge lies in combining rigorous analysis with practical implementation. While every LP aims to back top-tier managers, few have developed systematic processes to consistently identify them. This article draws from two decades of institutional private equity experience to provide a practical framework for manager selection.

Three principles guide leading LPs in their evaluation process:

- Systematic scoring across clear evaluation criteria - as detailed in our rating framework below

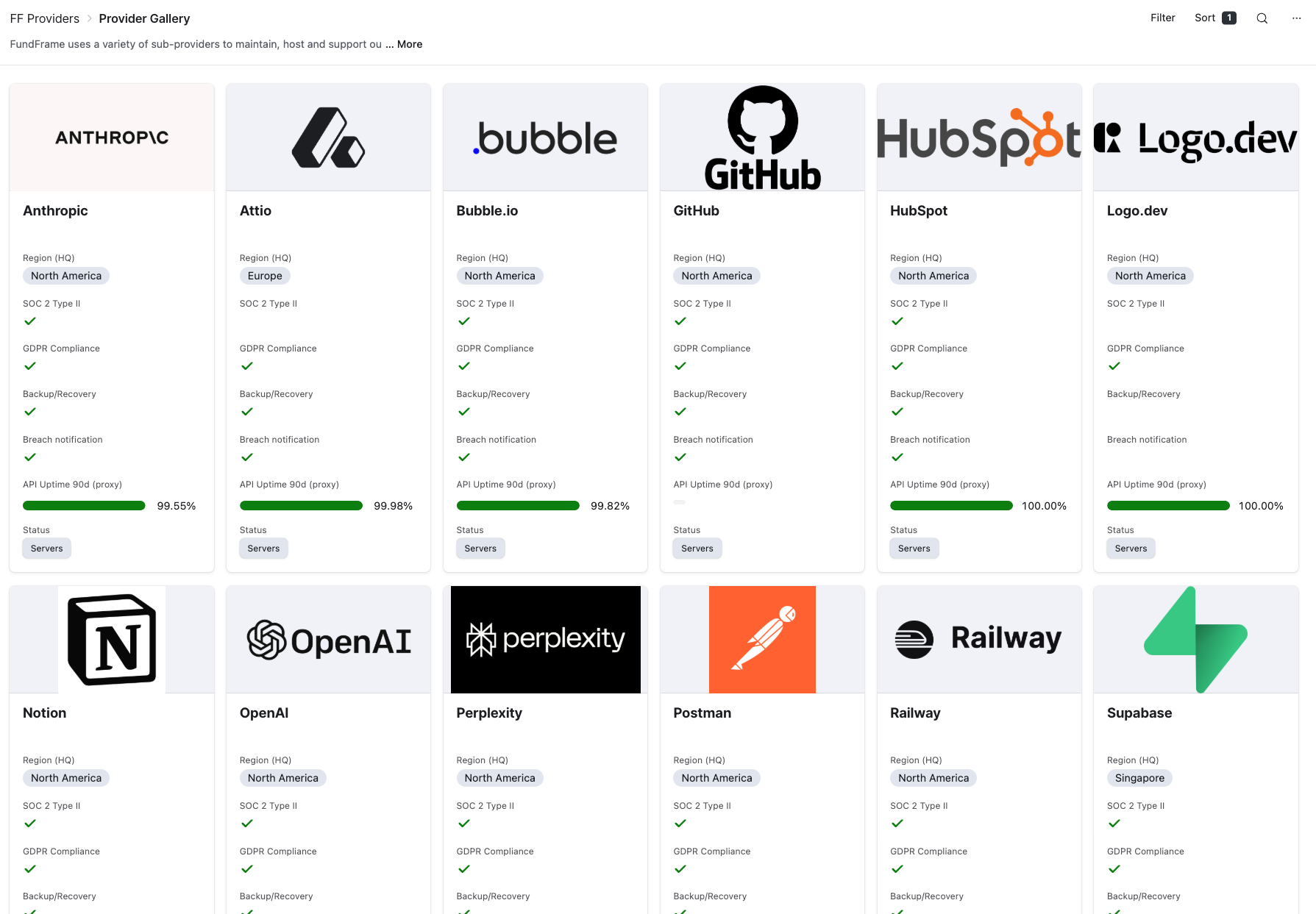

- Consistent documentation of manager interactions - supported by modern tools and platforms

- Regular calibration against a broad set of manager meetings - built through disciplined meeting practices

The Rating Framework: Four Categories for Systematic Evaluation

High Relevant (A)

A manager that demonstrates excellence across all key criteria:

- Clear, focused investment strategy with demonstrable competitive advantages

- Consistent track record of superior returns across market cycles

- Stable team with clear succession planning

Relevant (B)

A manager that meets most key criteria but may have areas needing improvement:

- Well-defined investment strategy, though competitive advantages may be less distinct

- Solid track record, though perhaps not consistently top-quartile

- Generally stable team with some succession clarity

Neutral (C)

A manager that meets basic investment criteria but shows notable gaps:

- Investment strategy fits criteria but lacks clear differentiation

- Mixed track record or volatile returns

- Some team stability concerns or succession uncertainty

Not Relevant (D)

A manager that falls outside investment criteria or shows major concerns:

- Unclear or frequently changing investment strategy

- Poor track record or major performance concerns

- Significant team instability or succession issues

Key Areas to Evaluate

After reviewing thousands of managers, clear patterns emerge in what separates exceptional GPs from the rest. While individual managers may excel in different ways, systematic excellence leaves consistent traces across five key dimensions. The table below distills decades of institutional investing experience into practical guidance for manager evaluation.

For each dimension, we've identified specific positive indicators to look for, as well as red flags that often signal deeper concerns. These aren't merely theoretical frameworks – they're battle-tested indicators drawn from real investment experience. Our case study GP demonstrated excellence across these dimensions, but more importantly, they showed how these elements work together to create sustainable success.

Use this table as a reference during your manager meetings, but remember: the key isn't checking boxes, but understanding how these elements combine to create repeatable success. Pay particular attention to how consistently these traits appear across the organization, rather than just at the senior level.

From Framework to Action: Making the Most of Your Hour

While the evaluation framework provides a comprehensive view of what to assess, the real challenge lies in gathering these insights efficiently. In private equity, first impressions matter - but they shouldn't be left to chance. Initial meetings with GPs often feel like a flood of information about deals, returns, and market perspectives. The key is approaching these sessions with a structured plan that helps you quickly assess the fundamentals: Is there real differentiation in their strategy? Do they have repeatable processes, or just a collection of good deals? How does the team actually work together?

While no two meetings are the same, here is a general template that can be used in meetings.

Before the meeting: 15 minutes of preparation

Quick but focused preparation before each meeting is essential. Review the pitch deck as well as earlier meetings notes with specific attention to:

- Strategy consistency and potential drift

- Track record patterns and attribution

- Recent team changes or developments

Initial introduction (First 10 Minutes)

The opening moments of any GP meeting reveal crucial insights about team dynamics:

- Watch how the team enters and sets up

- Note who leads and who handles support tasks

- Observe natural interaction patterns

The core discussion (35 Minutes)

Focus on identifying systematic value creation versus individual brilliance:

- Challenge assumptions in their strategy

- Go through case studies

- Probe for depth beyond the senior team

- Look for evidence of repeatable processes

Wrapping things up (Last 15 Minutes)

Use the final minutes to address any remaining concerns:

- What deal did they pass on and why?

- How do they see their team and strategy evolving?

- What keeps them up at night?

The Power of Systematic Documentation

The moments immediately following a GP meeting are crucial. While impressions are still fresh, successful evaluators take time to systematically document their observations. This isn't merely about record-keeping – it's about building institutional knowledge that deepens with each manager interaction.

Developing Investment Judgment

While frameworks provide structure, true investment acumen comes from experience. The most successful LPs combine rigorous processes with nuanced judgment developed through hundreds of manager meetings. They know that pattern recognition isn't built overnight – it comes from systematic exposure to diverse managers and regular calibration with peers.

Consider how one fund-of-funds manager describes their evolution:

"In our early days, we followed frameworks religiously. Over time, we learned to read between the lines. When a junior partner gets interrupted, or a founding partner dominates every answer, that tells you as much about succession planning as any formal documentation. But you only develop that insight by seeing it play out across multiple managers over time."

The Art of Manager Selection

At its core, successful manager selection combines systematic evaluation with nuanced judgment. The best investors don't simply seek perfect scores across every dimension – they look for managers who demonstrate sustainable, repeatable excellence in their chosen approach.

Think back to our services-focused GP. They weren't perfect: their returns weren't stellar, their strategy wasn't unique, and their fund sizes grew with success. Yet they exemplified what matters most: systematic processes, clear alignment between strategy and execution, and repeatable value creation. In the end, that's what separates truly exceptional managers from the pack.

The goal isn't finding perfection – it's identifying managers who can deliver consistent success through systematic processes rather than individual brilliance. By combining rigorous frameworks with experienced judgment, LPs can build portfolios of managers who don't just promise excellence, but demonstrate it consistently through their actions and results.